Music video by The Record Company performing Off The Ground. © 2015 Concord Music Group, Inc.http://vevo.ly/ILHxUw. See more of Off The Record on Facebook. Create New Account. See more of Off The Record on Facebook. Create New Account. EnergyX Solutions Inc. On Writing & Publishing Anxiety. October 19 at 6:08 PM.

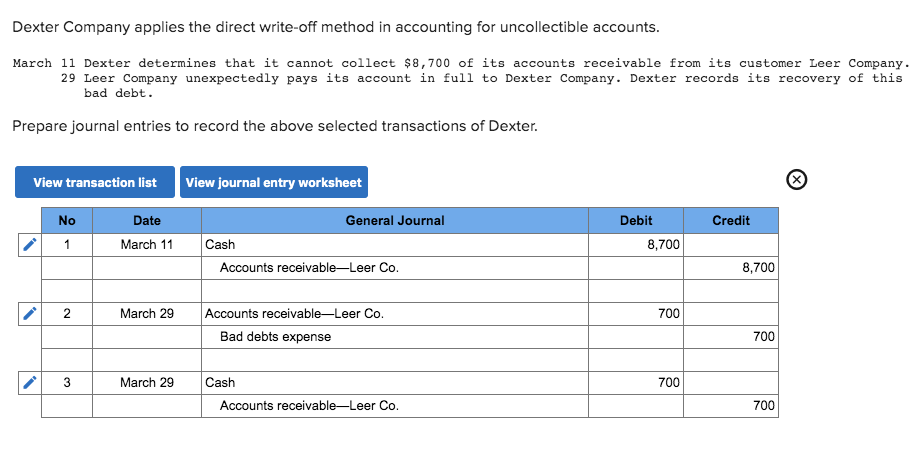

A bad debt can be written off using either the direct write off method or the provision method. The first approach tends to delay recognition of the bad debt expense. It is necessary to write off a bad debt when the related customer invoice is considered to be uncollectible. Otherwise, a business will carry an inordinately high accounts receivable balance that overstates the amount of outstanding customer invoices that will eventually be converted into cash. There are two ways to account for a bad debt, which are as follows:

Direct write off method. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. It may also be necessary to reverse any related sales tax that was charged on the original invoice, which requires a debit to the sales taxes payable account.

Provision method. The seller can charge the amount of the invoice to the allowance for doubtful accounts. The journal entry is a debit to the allowance for doubtful accounts and a credit to the accounts receivable account. Again, it may be necessary to debit the sales taxes payable account if sales taxes were charged on the original invoice.

In either case, when a specific invoice is actually written off, this is done by creating a credit memo in the accounting software that specifically offsets the targeted invoice.

Of the two methods presented for writing off a bad debt, the preferred approach is the provision method. The reason is based on the timing of expense recognition. If you wait several months to write off a bad debt, as is common with the direct write off method, the bad debt expense recognition is delayed past the month in which the original sale was recorded. Thus, there is a mismatch between the recordation of revenue and the related bad debt expense. The provision method eliminates this timing problem by requiring the establishment of a reserve when sales are initially recorded, so that some bad debt expense is recognized at once, even if there is no certainty about exactly which invoices will later become bad debts.

Related Courses

Bookkeeping Guidebook

How to Audit Receivables

New Controller Guidebook

A fixed asset is written off when it is determined that there is no further use for the asset, or if the asset is sold off or otherwise disposed of. A write off involves removing all traces of the fixed asset from the balance sheet, so that the related fixed asset account and accumulated depreciation account are reduced.

There are two scenarios under which a fixed asset may be written off. The first situation arises when you are eliminating a fixed asset without receiving any payment in return. This is a common situation when a fixed asset is being scrapped because it is obsolete or no longer in use, and there is no resale market for it. In this case, reverse any accumulated depreciation and reverse the original asset cost. If the asset is fully depreciated, that is the extent of the entry.

Example of How to Write Off a Fixed Asset

For example, ABC Corporation buys a machine for $100,000 and recognizes $10,000 of depreciation per year over the following ten years. At that time, the machine is not only fully depreciated, but also ready for the scrap heap. ABC gives away the machine for free and records the following entry.

| Debit | Credit |

| Accumulated depreciation | 100,000 |

| Machine asset | 100,000 |

A variation on this first situation is to write off a fixed asset that has not yet been completely depreciated. In this situation, write off the remaining undepreciated amount of the asset to a loss account. To use the same example, ABC Corporation gives away the machine after eight years, when it has not yet depreciated $20,000 of the asset's original $100,000 cost. In this case, ABC records the following entry:

| Debit | Credit |

| Loss on asset disposal | 20,000 |

| Accumulated depreciation | 80,000 |

| Machine asset | 100,000 |

The second scenario arises when you sell an asset, so that you receive cash (or some other asset) in exchange for the fixed asset you are selling. Depending upon the price paid and the remaining amount of depreciation that has not yet been charged to expense, this can result in either a gain or a loss on sale of the asset.

For example, ABC Corporation still disposes of its $100,000 machine, but does so after seven years, and sells it for $35,000 in cash. In this case, it has already recorded $70,000 of depreciation expense. The entry is:

| Debit | Credit |

| Cash | 35,000 |

| Accumulated depreciation | 70,000 |

| Gain on asset disposal | 5,000 |

| Machine asset | 100,000 |

What if ABC Corporation had sold the machine for $25,000 instead of $35,000? Then there would be a loss of $5,000 on the sale. The entry would be:

| Debit | Credit |

| Cash | 25,000 |

| Accumulated depreciation | 70,000 |

| Loss on asset disposal | 5,000 |

| Machine asset | 100,000 |

Timing of Fixed Asset Write-Offs

A fixed asset write off transaction should only be recorded after written authorization concerning the targeted asset has been secured. This approval should come from the manager responsible for the asset, and sometimes also the chief financial officer.

Fixed asset write offs should be recorded as soon after the disposal of an asset as possible. Otherwise, the balance sheet will be overburdened with assets and accumulated depreciation that are no longer relevant. Also, if an asset is not written off, it is possible that depreciation will continue to be recognized, even though there is no asset remaining. To ensure a timely write off, include this step in the monthly closing procedure.

Related Courses

Off The Record: Method Writing Definition

Fixed Asset Accounting

How to Audit Fixed Assets